Incentives

GET TO PAYOFF FASTER WITH INCENTIVES

Both Federal and Florida incentives help you to pay for your solar electric system.

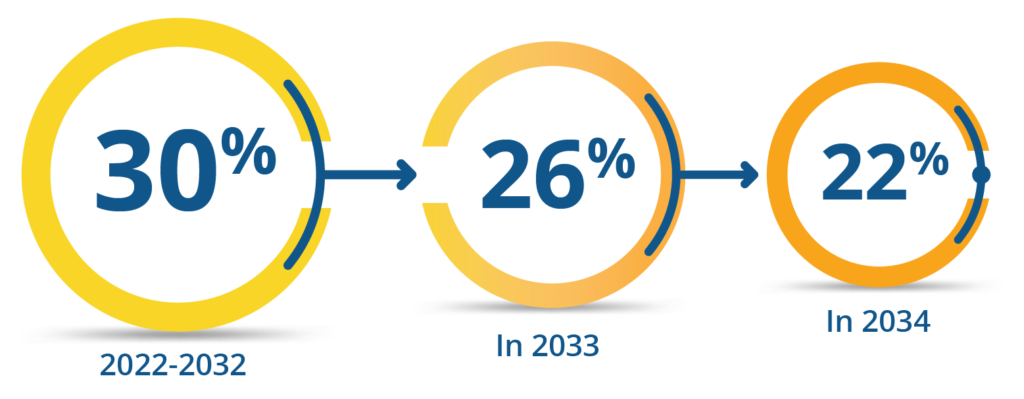

Federal ITC

The Investment Tax Credit (ITC*) is worth 30 percent of the system cost and may be deducted from your Federal income tax. The tax credit is set to expire at the end of 2034 for residential installations. It is available to those who buy their system (cash or loan), not to those who lease. It may be rolled forward if you do not have enough tax liability in the installation year to use it in its entirety.

*Please consult your tax adviser regarding your individual tax situation and income tax credit eligibility. Don’t wait, prices for solar equipment are on the rise!

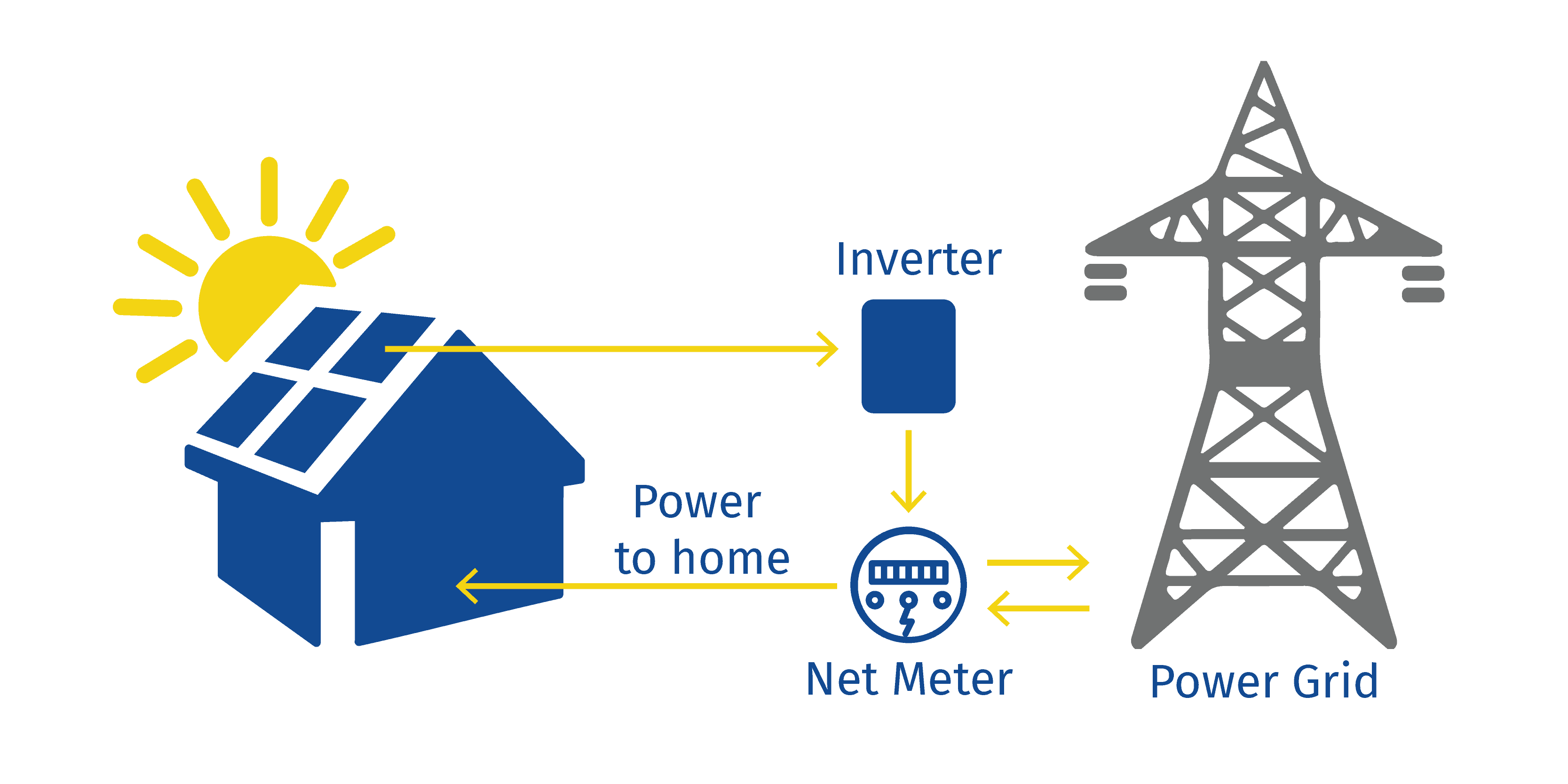

Florida Net Metering

Florida provides a system by which solar panels or other renewable energy generators are connected to the grid, allowing customers to offset the cost of the power they draw from the utility with credits they earn on their own production. In Florida, unlike other locations, there are no limits on net metering capacity, so every home in a neighborhood could be connected to the grid. So, when your solar system produces more power than you need, the excess is captured by the grid, which you will see as a credit on your electric bill.

Florida Property Tax Exemption

When you install a solar electric system, the value of your home increases. Homeowners in Florida enjoy a property tax exemption that allows them to pay property taxes at the rate they paid before the solar installation. The value of their home will not be reassessed. For residential properties, the exemption is 100% of the increased value. It is 80% for non-residential installations.

Florida Sales Tax Exemption

In Florida, there is no sales tax on the purchase and installation of a solar energy system. This means up to a 7% savings.

Increase in Home Value

Having a residential solar energy system on your property is known as a capital improvement which adds to your property’s value*. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax-basis investment can be deducted from the sales price, reducing the amount of the price counted as profit. This reduces the taxes** taken from the sale and may be able to help you avoid capital gains taxes on appreciation.